Home is more than just having a place to call your own; it’s a financial investment that appreciates over time. But have you ever wondered how to increase the value of your home?

While factors like location and market demand are out of your control, the improvements you make in your home can directly impact its worth.

Whether you’re considering selling or want to build equity, taking the right steps can make all the difference, significantly boosting your home’s appeal and market value.

Ever wonder how to increase the value of your home with a warranty? It can be a compelling differentiator because it provides full coverage for appliances and systems.

Table of Contents

Home Warranty Types for Different Roles in Real Estate

We are here with a definitive article that helps you understand how to increase the value of your home with a home warranty. Let’s start with what it actually means.

Home warranties aren’t the same for everyone. Different plans exist to serve the needs of various stakeholders connected to a property. Here’s an overview of the types of home warranty plans you may come across:

Homeowner’s Warranty

A homeowner’s warranty serves as a safety net for your investment. It helps cover the costs associated with repairing or replacing appliances and systems that break down due to normal wear and tear, everything from kitchen appliances to heating and cooling systems.

When you have a home warranty, there will likely come a time when you need to use it. It’s a simple fact that appliances and home systems don’t last forever, and their condition will eventually decline.

The good news? Your home warranty will connect you with a qualified service contractor to help with repairs when that happens.

Home Buyer’s Warranty

Buying a home can feel overwhelming. From finding a realtor, touring houses, placing bids, and dealing with paperwork, there’s a lot on your plate. Amidst it all, you might hear about a “home warranty.” But what exactly is it, and why should you consider one as a homebuyer?

A homebuyer’s warranty is a policy you can purchase at closing. It helps ensure that if appliances or systems break down, the repairs will be affordable. This added security can be a real comfort, especially when your budget is stretched thin after buying a home.

Home Seller’s Warranty

A home seller’s warranty might be a wise investment for homeowners planning to sell their property soon. Selling a property can be challenging, and every seller aims to get the most return on their investment.

A seller’s warranty can help tip the scales in your favor, leading to a faster sale and potentially higher profits. Many buyers worry about unexpected breakdowns or appliance failures, but a home warranty provides reassurance and protection. It adds an extra layer of trust and confidence to the home-selling process.

Realtor’s Warranty

Another category of warranty plans is created for real estate agents and their properties, known as realtor’s warranty. Rather than having homeowners invest in the policy, realtors can collaborate with home warranty providers to offer comparable services. Usually, the agent will pass the policy to the buyer after closing.

A home warranty can be a valuable tool if you’re a realtor wanting to boost your sales and close deals faster. It gives buyers confidence in their purchase, allowing you to sell at a higher price and speed up the closing process.

Hopefully, now you have a generic idea of how to increase the value of your home. If you are still confused about how a home warranty can benefit you, read our guide here.

The Impact of a Home Warranty on Your Home’s Value

A home warranty adds value to your property and helps you negotiate a better deal when it’s time to sell. Here’s how to increase home value with a warranty.

Gain a Competitive Edge

With so many properties on the market, how can you make your home the one buyers want? A home warranty is a great way to stand out.

When buyers see that your home is covered, their concerns about repairs and maintenance decrease. This perception enhances your home’s value and helps you close the sale more quickly.

Nail Your Home Inspection

Before closing the deal, most home buyers schedule a home inspection to check the property’s condition. If a warranty covers your major home components, you will likely have a smooth inspection that eases buyer concerns. A solid inspection can work in your favor, allowing you to increase your home’s value and negotiate better terms.

Reassuring Buyers with a Home Warranty

Buyers often worry about future maintenance costs even with a thorough home inspection. Offering a home warranty shows them that major appliances are covered, reducing their worries about future costs. This added security can make your home more desirable, increasing its value and demand.

Increase Your Selling Price

With a home warranty, you can justify a higher price and confidently ask for it. Buyers are drawn to properties with warranties, knowing they’re protected. Regular maintenance and repairs will add more value to your home, and you’re set to close with a good offer and profit.

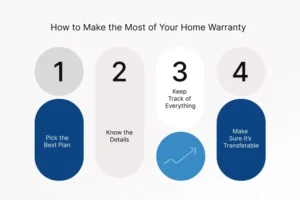

How to Make the Most of Your Home Warranty

A home warranty is a great tool to add value to your property, but are you maximizing its worth? Here are a few key steps to help you get the most from your coverage:

-

- Pick the Best Plan: Choose a reliable home warranty provider with a plan that covers the most essential appliances and systems so you don’t get stuck with uncovered repairs.

- Know the Details: Make sure you’re clear on what’s included in your warranty and what’s not, including any out-of-pocket costs. This knowledge will be useful when selling your home.

- Keep Track of Everything: Maintain records of all repairs and maintenance completed under your warranty. This can be a great asset when showing buyers the home’s well-kept condition.

- Make Sure It’s Transferable: Check if your warranty can be transferred to the new homeowner, as this will give them coverage right from the start and add to their peace of mind.

Select Home Warranty offers comprehensive coverage for your essential home appliances. Explore our home warranty plans or call us at 800-670-8931 today !

Make Home Warranty Your Priority For Greater Home Value

Homeownership can come with plenty of financial concerns, but a home warranty eases those worries by simplifying your home maintenance process and keeping costs in check. Since a home warranty is transferable to new owners, it gives you an edge when it’s time to sell.

Even if selling isn’t on your radar right now, a home warranty is still necessary as it protects your budget from costly repairs and includes additional perks that help keep building value in your home over the long term.

Find out how to increase the value of your home by using a home warranty plan that fits your needs. You can also check Select Home Warranty prices and plans for better understanding. You can also explore DIY and maintenance guides on home appliances to fix common issues or else take help from Select.

We are here to make your homeownership experience stress-free by covering the critical systems and appliances that matter most. With our comprehensive plans, you can rest easy knowing your home is well-protected!

Let’s wrap up by adding some key takeaways on how to increase the value of your home.

-

-

- Complete knowledge of Home Warranty

- Right Coverage Plan and

- Trusted Service Provider

-

So, whether you’re thinking of selling or staying put, a reliable home warranty is a smart step toward maintaining and growing your home’s value with minimal effort.